𝑫𝒐 𝒚𝒐𝒖 𝒌𝒏𝒐𝒘… 𝒘𝒉𝒂𝒕 𝒂𝒏 𝑰𝒎𝒑𝒂𝒄𝒕 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 𝒊𝒔?

It is an investment that intentionally seeks a positive social or environmental outcome and generates a financial return. For a Congregation like the MSCs, this ministry goes way beyond the investments themselves; it is expression of our Charism.

“As Missionary Sisters of the Sacred Heart of Jesus, with limited human resources but rich in missionary zeal, we have recognized that the purpose of our temporal goods needs to be refocused. We decided to dispense with subjugating ourselves to secular financial wisdom and to very deliberately respond to the Church’s demand to recognize ourselves only as stewards, not owners of our temporal goods. With this as our reference, we are determined to use our financial resources to express a new model of apostolic ministry and broaden our effectiveness of spreading God’s love to all the corners of the Earth without the physical presence of Sisters.” Sr. Barbara Staley, MSC

𝑫𝒐 𝒚𝒐𝒖 𝒌𝒏𝒐𝒘 𝒕𝒉𝒂𝒕… 𝑰𝒎𝒑𝒂𝒄𝒕 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕𝒔 𝒂𝒓𝒆 𝒃𝒆𝒄𝒐𝒎𝒊𝒏𝒈 𝒊𝒏𝒄𝒓𝒆𝒂𝒔𝒊𝒏𝒈𝒍𝒚 ‘𝒑𝒐𝒑𝒖𝒍𝒂𝒓’ 𝒂𝒎𝒐𝒏𝒈 𝒓𝒆𝒍𝒊𝒈𝒊𝒐𝒖𝒔 𝑪𝒐𝒏𝒈𝒓𝒆𝒈𝒂𝒕𝒊𝒐𝒏𝒔?

In October 2019, Catholic Impact Investing Collaborative (CIIC) officially launched the Catholic Impact Investing Pledge. The 35 pledge was signed by partners and includes a global group of pioneering Catholic institutions who have led the way on impact investing, representing 6 countries and over $40B in assets. This group has committed not only to maintain their focus on internal impact investment programs but is also helping to grow the broader ecosystem of Catholic impact investing.

As MSCs, we have developed an important role catalyzing other Catholic institutions to invest their assets responsibly and for social impact. We must acknowledge that our impact investing program follows in the footsteps of the pioneering women religious that have been engaged in impact investing long before the term was coined. As such, we felt compelled to share our learnings with other mission aligned investors, particularly Catholic asset owners who want to make impact investments but do not have the operational capacity to do so.

𝘿𝙤 𝙮𝙤𝙪 𝙠𝙣𝙤𝙬…. 𝙬𝙝𝙖𝙩 𝙞𝙨 𝙩𝙝𝙚 𝙘𝙤𝙣𝙣𝙚𝙘𝙩𝙞𝙤𝙣 𝙗𝙚𝙩𝙬𝙚𝙚𝙣 𝙋𝙤𝙥𝙚 𝙁𝙧𝙖𝙣𝙘𝙞𝙨’ 𝙨𝙚𝙣𝙩𝙚𝙣𝙘𝙚 “𝙒𝙚 𝙢𝙪𝙨𝙩 𝙬𝙖𝙡𝙠 𝙤𝙣 𝙩𝙬𝙤 𝙛𝙚𝙚𝙩: 𝘾𝙝𝙖𝙧𝙞𝙩𝙮 𝙖𝙣𝙙 𝙅𝙪𝙨𝙩𝙞𝙘𝙚” 𝙖𝙣𝙙 𝙄𝙢𝙥𝙖𝙘𝙩 𝙄𝙣𝙫𝙚𝙨𝙩𝙢𝙚𝙣𝙩𝙨?

Pope Francis said that through Impact Investments we are “Incarnating human dignity and solidarity in the structures of our economic life”. Have you heard the saying “Give a person a fish and they eat for a day, teach them how to fish and you feed them for a lifetime”? That is the difference between charity and justice.

A loan is the way to “teach them to fish and they have a livelihood for life.” It is about justice, not charity. A loan is a long-term investment that says “I will partner with you so that you will thrive. I believe you have a future, and I will invest in it for your benefit.” And when the loan is paid back that creates an opportunity to give someone else a chance to borrow and thrive. So our borrowers are helping others!

Sr. Corinne Florek, OP

𝘿𝙞𝙙 𝙮𝙤𝙪 𝙠𝙣𝙤𝙬 𝙩𝙝𝙖𝙩… 𝙄𝙢𝙥𝙖𝙘𝙩 𝙄𝙣𝙫𝙚𝙨𝙩𝙞𝙣𝙜 𝙞𝙨 𝙖 𝙩𝙤𝙤𝙡 𝙛𝙤𝙧 𝙢𝙞𝙨𝙨𝙞𝙤𝙣?

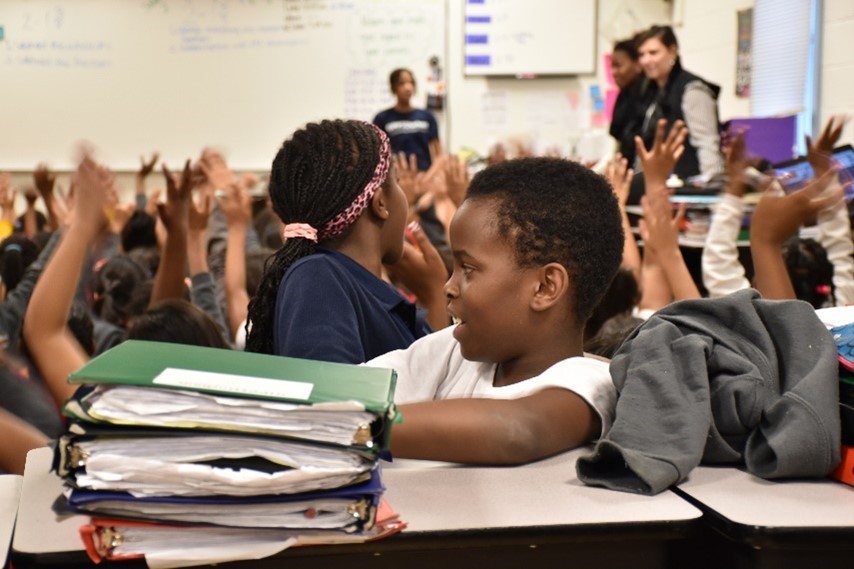

The mission of the impact investment portfolio parallels the mission of our organization broadly – to spread the Love of Jesus to the Ends of the Earth to the most vulnerable members of society, including women, children, migrants, and frail elders.

“Whenever I make a site visit to one of our borrowers, I ask to see the staff. I tell them about how Sisters are financially independent. So many people think the Bishops take care of us! I share how we care for each other with a common fund. I explain that our Sisters are aging and no longer able to start new ministries. So now we send our money on mission and they, the staff of that non-profit, are our co-ministers. Their mission is to help the people in their communities thrive and through our investment we partner with them. I hope they see that they are part of something which is much bigger than just a job. They are on mission for economic justice!”

Sr. Corinne Florek, OP

Investing in Regenesys, for example, allowed the MSCs to go to the Philippines without a physical presence, supporting women who have been rescued from human trafficking and providing them with fair wage job along with financial training, psychological support, health support, etc.

𝘿𝙤 𝙮𝙤𝙪 𝙠𝙣𝙤𝙬 𝙝𝙤𝙬 𝙙𝙤 𝙬𝙚 𝙨𝙚𝙡𝙚𝙘𝙩 𝙄𝙢𝙥𝙖𝙘𝙩 𝙄𝙣𝙫𝙚𝙨𝙩𝙞𝙣𝙜 𝙥𝙖𝙧𝙩𝙣𝙚𝙧𝙨?

All the principles contained in Catholic social teachings i.e. human dignity, common good, solidarity, subsidiarity, option for the poor, integral ecology, reciprocity/gratuity and universal destination of goods have become the criteria behind the choice of our partners.

Through the elements of Cabrini Charism we can learn how approach partnerships and which qualities our partners reflect. Based on Catholic Social Teachings and The Economy of Francesco, we know the financial structures of our deals and economic systems our work supports. Then, the UN Sustainable Development Goals give us the measurement of Impact Against benchmarks.

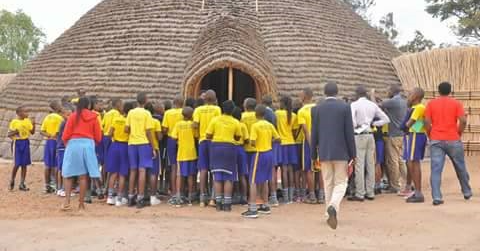

For example, through investing in One Acre Fund, our loan contributed to supplying about 1 million smallholder farms with everything they need to grow more food and earn more money in Sub-Saharan Africa.

Before joining One Acre Fund, Solange would harvest 30 kgs of beans, and a small bucket of maize and sweet potato. After two months, her family would run out of food, surviving on a piece of sweet potato daily. After joining One Acre Fund, Solange harvested three bags of maize (300 kgs), one bag each of beans, and sweet potato (100 kgs). She also received avocado tree seedlings. “Before One Acre Fund, it was bad as we lived in severe poverty. Now we eat well. In the next three years, my avocados will pay my children’s school fees.”

𝑫𝒐 𝒚𝒐𝒖 𝒌𝒏𝒐𝒘… 𝒘𝒉𝒂𝒕 𝒂𝒓𝒆 𝒕𝒉𝒆 𝒇𝒖𝒕𝒖𝒓𝒆 𝒄𝒉𝒂𝒍𝒍𝒆𝒏𝒈𝒆𝒔 𝒇𝒐𝒓 𝑰𝒎𝒑𝒂𝒄𝒕 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕𝒔?

We try to continuously challenge our own biases and ingrained ways of thinking with the goal of supporting more equitable financing terms that reflect the spirit of reciprocity and partnership, more equitable forms of ownership that provide opportunities for the poor to participate in the profits of the companies we finance, impact-linked financial returns, and more inclusive forms of decision making in allocating our capital that reflect the principle of subsidiarity.

In this way we can go where others do not go, remaining flexible and investing across a multitude of impact sectors, geographies, and asset types. And respond swiftly to the needs of our time and to the issues facing marginalized communities.

For example, through African Entrepreneur Collective, we provide loans and financial training and business support for entrepreneurs with a focus on supporting refugees in Kenya and Rwanda.

“The future will thus prove an exciting time that summons us to acknowledge the urgency and the beauty of the challenges lying before us. A time that reminds us that we are not condemned to economic models whose immediate interest is limited to profit and promoting favorable public policies, unconcerned with their human, social and environmental cost.” Pope Francis

Impact Investing Posts in Spanish:

https://www.cabriniworld.org/blog/posts-de-impact-investing-spa/

Impact Investing Posts in Italian:

https://www.cabriniworld.org/blog/posts-impact-investing-ita/

Impact Investing Posts in Portuguese:

https://www.cabriniworld.org/blog/posts-impacto-investir-por/